Discover key trends and opportunities driving the organic market in the United States and how your company can benefit from this ongoing growth.

During the BIOFACH 2024 fair, the LETIS team attended the presentation of the report “Trends in Organic Markets: United States”, delivered by Sarah Gorman, a member of the Organic Trade Association (OTA). Important data about the trends in the U.S. organic market was shared, allowing companies to understand consumer behavior and participate in this dynamic sector.

Interested in learning more? We invite you to read our full article.

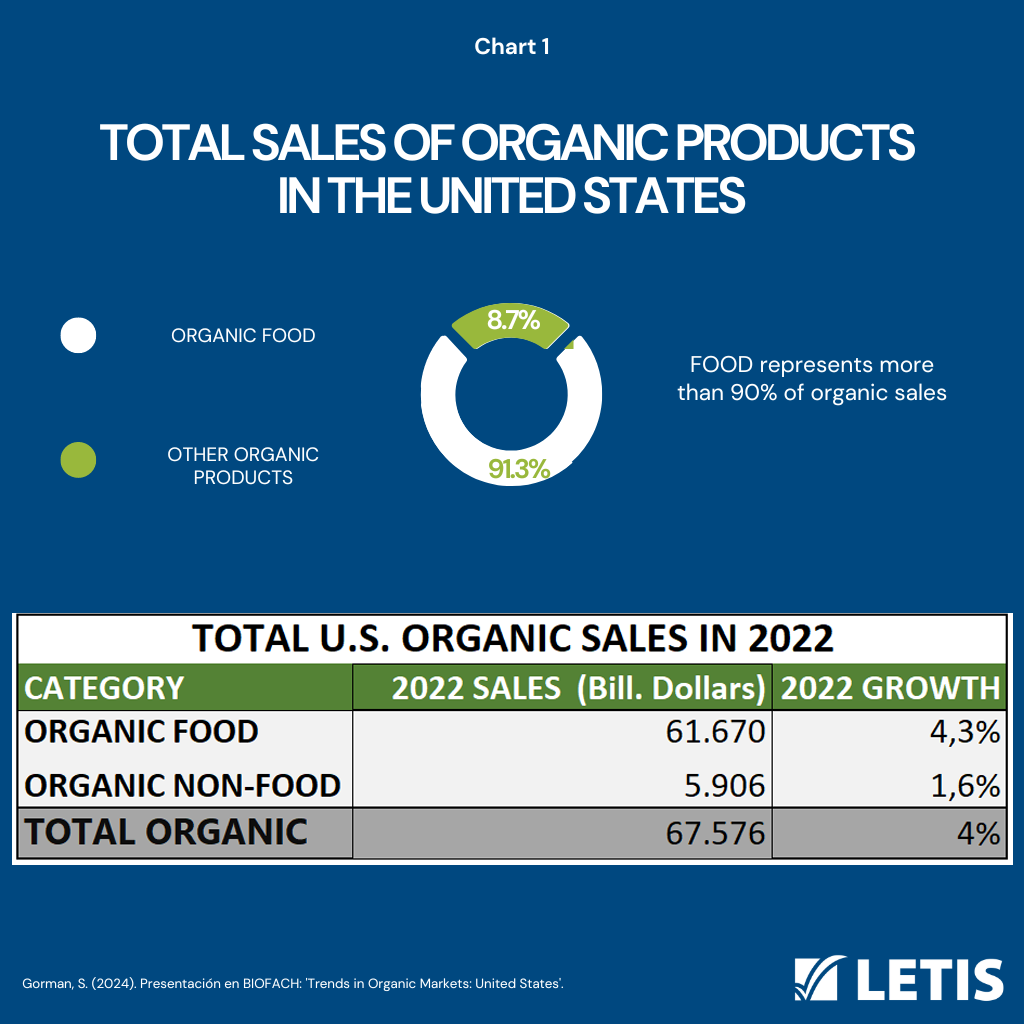

In the U.S. organic sector, food plays a fundamental role, representing more than 90% of total organic product sales. According to 2022 data, organic food sales reached an impressive $61.67 billion, experiencing a notable growth of 4.3% from the previous period. Other organic products contributed $5.906 billion to total sales, recording a growth of 1.6%.

These data, illustrated in Chart 1, underscore the growing preference of American consumers for organic foods and the continuous development of the organic market in general.

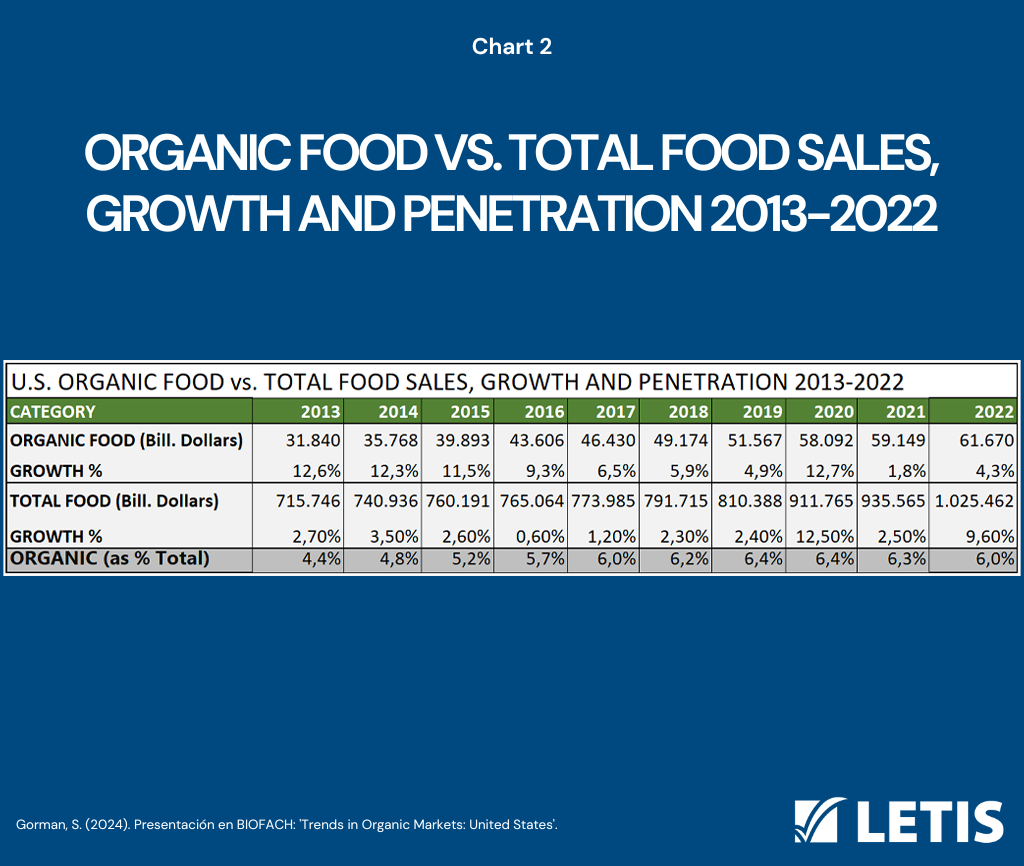

As shown in Chart 2, the evolution of the food market in the United States between 2013 and 2022 indicates a steady growth in organic foods. In 2013, organic food sales amounted to $31.84 billion, and over the years, they experienced progressive increases, reaching a total growth of 94.2%. This growth is especially notable when compared to the total food market growth, which was 9.6% during the same period.

In percentage terms, the organic food segment has maintained solid growth rates, with an average annual increase of 7.7% since 2013. In contrast, the average annual growth of the total food market was 3.4%. Additionally, the share of organic foods in the total market has shown consistent growth, representing 6% of the total in 2022, compared to 4.4% in 2013. These data highlight the upward trend and the growing consumer preference for organic foods in the United States.

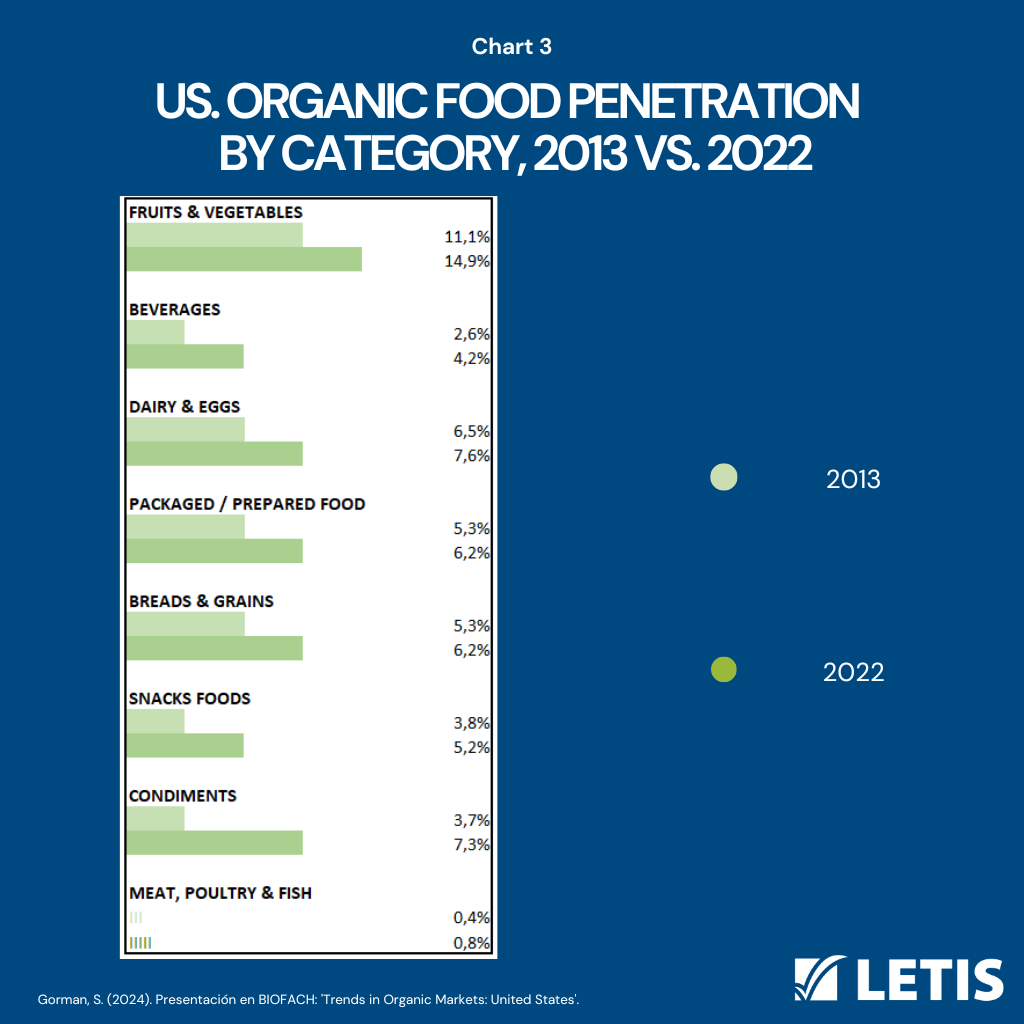

The presence of organic foods stands out in various categories, as seen in Chart 3. Fruits and vegetables lead with a presence of 11.1% in 2013, increasing to 14.9% in 2022. In the beverages category, organic participation has evolved from 2.6% in 2013 to 4.2% in 2022. Similarly, dairy and eggs have experienced growth from 6.5% to 7.6% over the same period. Other sectors, such as packaged or prepared foods, breads and grains, snacks, condiments, and meat, poultry, and fish, have also seen increases, reflecting the growing consumer preference for healthier and more sustainable options.

The Positive Impact of Organics on Retail

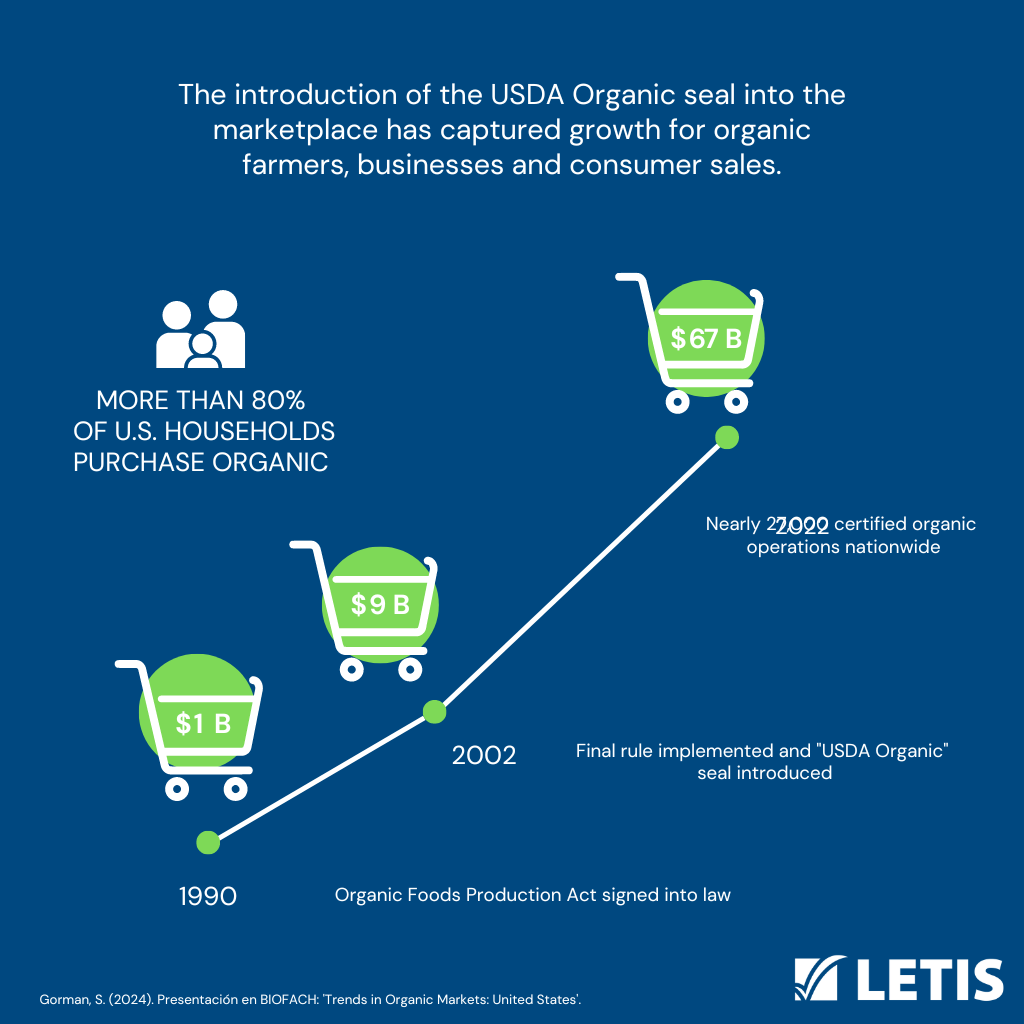

On the other hand, the social recognition of the USDA Organic seal by consumers has been a key catalyst for the growth of both organic farmers and sector companies, generating a positive impact on sales.

Currently, more than 80% of households in the United States buy organic products. This high percentage highlights the growing consumer preference for organic products in their purchasing choices.

In our article titled “Highlighting Opportunities: Analysis of the U.S. Organic Market for Argentine Exporters,” we explore these advances in more detail and offer comprehensive information on the imports of organic products in the United States.

Consumer Behavior:

In a context of increasing environmental awareness, more than 50% of U.S. consumers consider organic labels “important” for fresh products, animal-origin products, and baby items. However, a lower importance is assigned to products such as alcohol, snacks, and non-alcoholic beverages.

The findings of the OTA study “Consumer Perception of USDA Organic and Competing Label Claims Study” revealed other encouraging results for this sector. According to the results, 32% of consumers associate organic products with health benefits, while 31% link them to the absence of chemicals, hormones, pesticides, artificial additives, and antibiotics. Additionally, 27% consider that these products contribute to sustainability, protect the environment, and address climate change, marking a significant difference from other labels that are not perceived as beneficial in this regard.

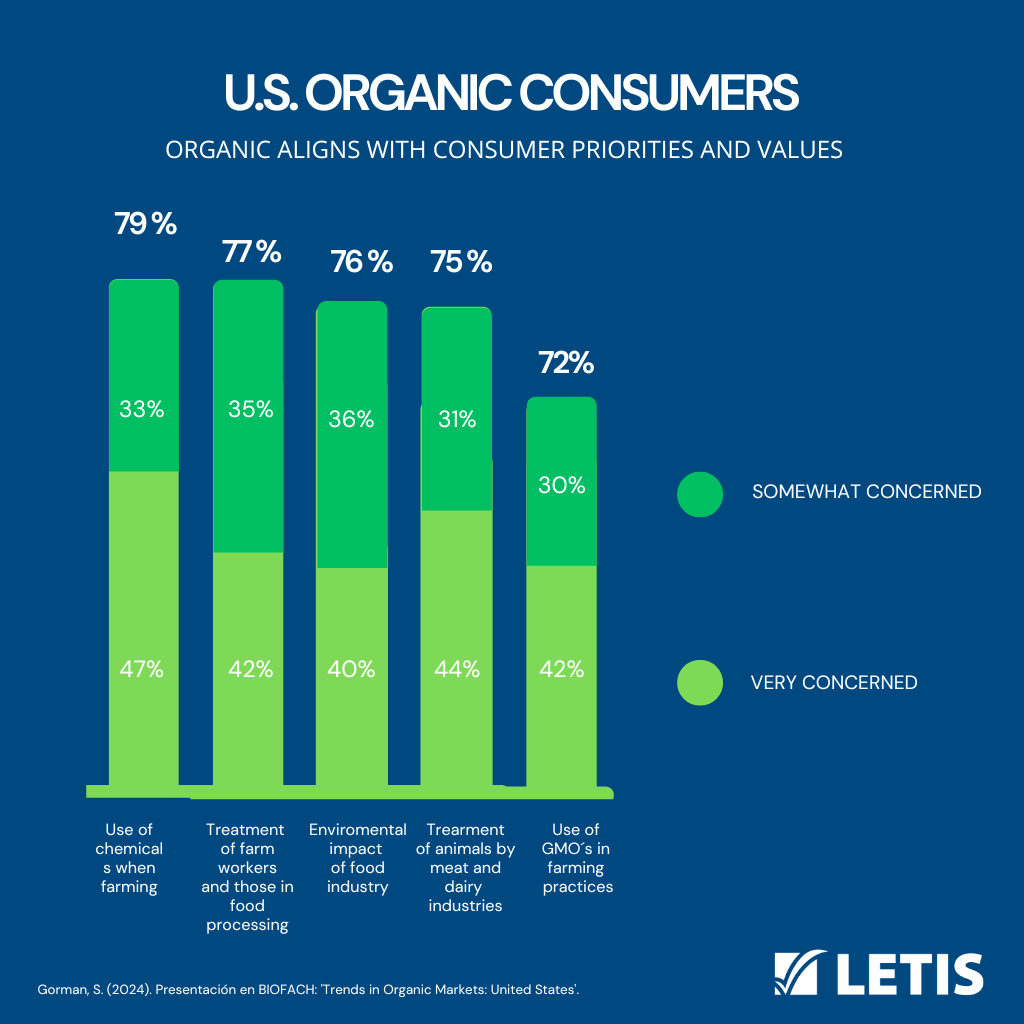

The consumption of organic products in the United States reflects the concerns, priorities, and values of consumers to varying degrees. The consumers, who are the target of the study, express diverse concerns (somewhat concerned or very concerned) regarding five main aspects of production:

- Use of chemicals in agriculture,

- Treatment of agricultural workers and those in food processing,

- Environmental impact of the food industry,

- Treatment of animals by the meat and dairy industries,

- Use of Genetically Modified Organisms (GMOs) in agricultural practices.

These concerns motivate consumers to choose organic products over other types of products.

Moreover, consumers in the United States show a high willingness to pay more for products they consider healthier and more nutritious. 53% of respondents are willing to pay a higher price for products considered “healthier,” and 46% for those considered “more nutritious.”

Additionally, more than 50% of respondents believe that organic products offer greater health benefits compared to their non-organic alternatives. Furthermore, the term “organic” is associated with a justifiably higher price by 44% of consumers, surpassing other claims.

This willingness to pay a higher price for organic products indicates a promising future for their commercialization. The certification costs are offset by the perceived value of these products, which is recognized and accepted by customers who are willing to pay more for them.

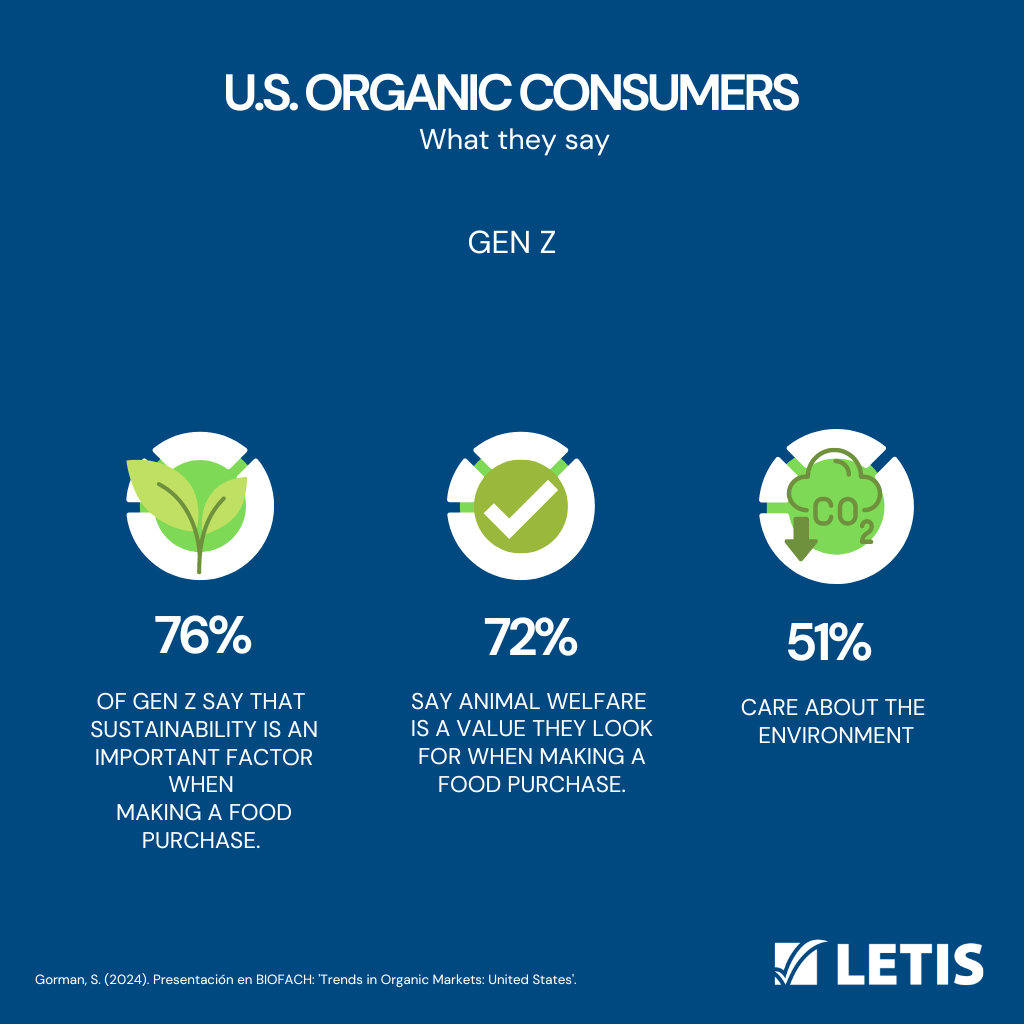

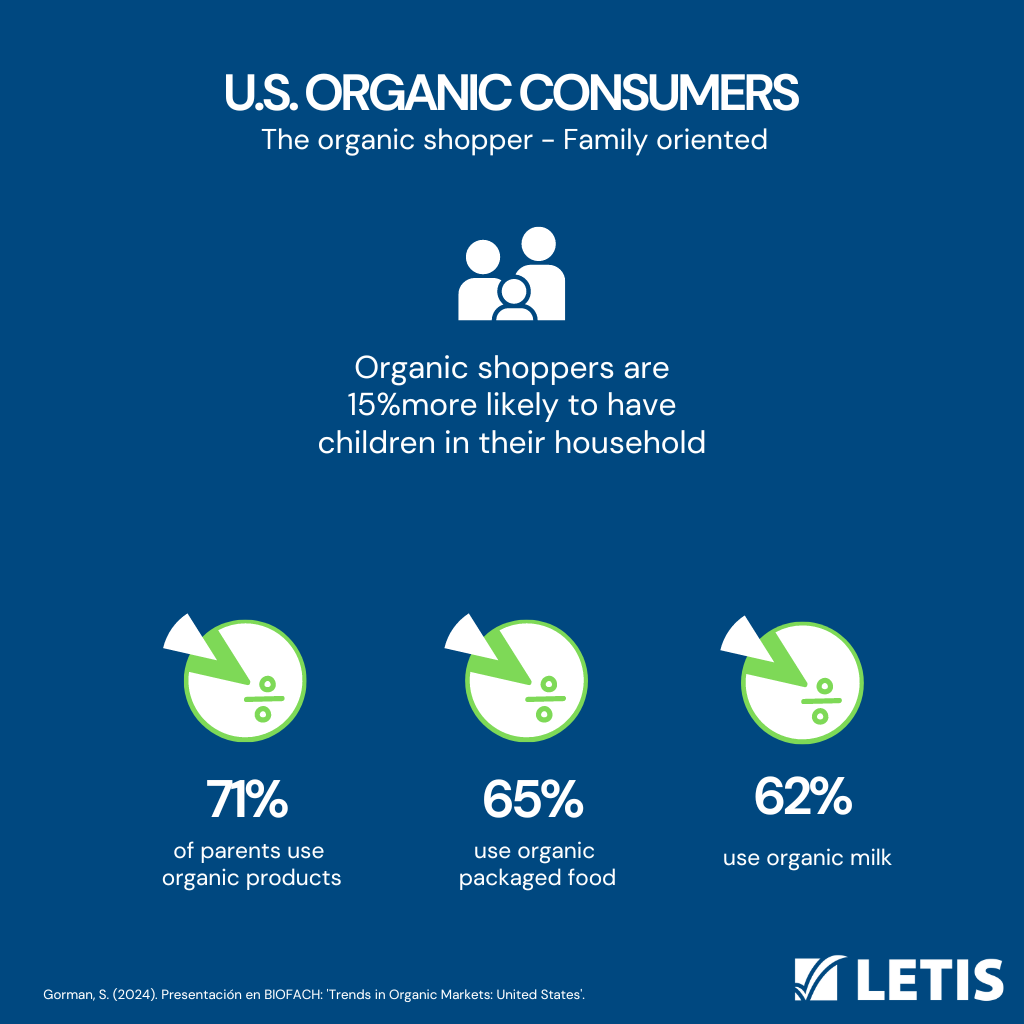

Consumers who value organic products are typically between 25 to 54 years old, have health concerns, and reside in suburban communities. Additionally, organic product buyers are 15% more likely to have children in their household.

Furthermore, the study has observed a positive correlation between the knowledge of the characteristics of organic products, their beneficial impact on the environment and the health of those who consume them, and consumers’ willingness to pay more for them. In other words, the greater the knowledge of the benefits of organic products, the greater the willingness to pay a higher price.

In conclusion, the U.S. organic market is experiencing unprecedented growth, supported by the growing consumer preference for healthy and sustainable products. The information presented highlights the importance of organic labeling and the differentiation between the terms “organic” and “natural.” Additionally, the positive impact of the USDA Organic seal is reflected in its social recognition and its contribution to the growth of organic farmers and companies.

It is crucial for companies to be aware of these trends and opportunities in the organic market to take advantage of this continuous growth. With a deeper understanding of consumer preferences and values, companies can adapt their marketing strategies and product development to better meet market demands.